How to Get an Ein Online Again

Did you become an mistake when applying for an EIN? We explicate the most common EIN reference numbers (errors) beneath and how to resolve your EIN awarding.

IRS Phone Number & Contact Information

If you receive an EIN reference number that is not listed below, please call the IRS at 800-829-4933. Their hours of functioning are 7am to 7pm, Monday through Fri. If y'all find information virtually a reference number not listed below, please feel gratis to share your findings in the comment section below.

Tip: Press option 1, then 1, and so 3 to speak to an IRS operator.

EIN Application via Form SS-iv

You'll notice a lot of the solutions below reference mailing or faxing Grade SS-4 to the IRS. This is due to the fact that your EIN awarding requires a manual review procedure past the IRS.

We have instructions on how to apply for an EIN via Form SS-iv. Please see this lesson if needed: Apply for EIN for LLC with Form SS-4.

EIN Reference Number 101 (name conflict/duplicate):

IRS EIN Reference Number 101 is the about common error message that people experience while applying for an EIN online.

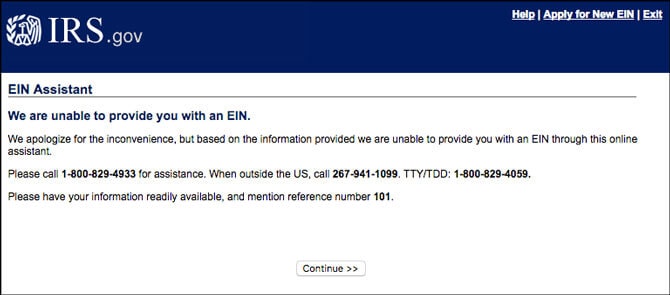

You'll encounter a bulletin that states "We are unable to provide you with an EIN. Nosotros apologize for the inconvenience, only based on the information provided we are unable to provide y'all with an EIN through this online assistant."

And you'll see this image:

Reference number 101 means the IRS has institute a business entity name that is too similar to the proper noun of your LLC. Although information technology may be unique in the state where you formed your LLC, the proper noun likely conflicts with the proper noun of a business from some other country. This isn't a large deal for business though, information technology merely ways the IRS needs to manually review your filing and you have to apply with Form SS-four.

Solution: File Form SS-4 by mail or past fax as the IRS volition need to manually review your EIN awarding. If yous formed an LLC, make sure to include your approved LLC filing form (Articles of Organization, Certificate of Arrangement, or Certificate of Formation) forth with Form SS-4.

EIN Reference Number 102 (SSN/ITIN error):

Reference number 102 means there is either a mismatch or an fault with the Responsible Party'south name and their Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN).

Solution: Try the EIN Online Application once more and make sure to enter the SSN or ITIN correctly. If yous withal see reference number 102, then we recommend filing Grade SS-4 by postal service or fax.

EIN Reference Number 103 (existing EIN error):

Reference number 103 means you've entered an existing visitor every bit the EIN Responsible Party and their records do not friction match. There is an EIN number and company proper noun mismatch.

Solution: Try the EIN Online Application once more and brand sure to enter the EIN correctly. If y'all yet get the mistake/reference number 103, then nosotros recommend filing Form SS-4 by postal service or fax.

EIN Reference Number 104 (Third Political party Designee conflict):

Reference number 104 means that a Third Party Designee (a person or company who assists in obtaining an EIN), has entered alien contact information. The IRS does not let a Third Party Designee to have the same contact data as the LLC, specifically an address (either physical or mailing) and a phone number.

Solution: Try the EIN Online Application again, making certain the 3rd Political party Designee's contact information is their own and is not the same as the LLC'south.

EIN Reference Number 105 (too many attempts):

Reference number 105 means that you've made too many attempts online to obtain the EIN (using the same SSN, ITIN, or EIN), each leading to an error reference/code.

Solution: Expect 24 hours and try the EIN Online Application over again. If you nevertheless receive an error message, then we recommend filing Form SS-iv by post or fax.

EIN Reference Number 106 (unmarried-fellow member LLC with no EIN):

Reference Number 106 means that your Single-Member LLC (which has employees) does not take a Sole Proprietorship EIN nonetheless.

Solution: Please contact the IRS as we're non sure what the next best step is. If you run into this problem and would like to share your solution, please leave a comment below.

EIN Reference Number 107 (single-member LLC with too many EINs):

Reference Number 107 means that your Single-Member LLC (which has employees) has more than than 1 Sole Proprietorship EIN.

Solution: Please contact the IRS as we're non sure what the solution is for reference number 107. If you discover the solution and would like to share, delight leave your experience beneath in the comments.

EIN Reference Number 109 (technical):

Reference number 109 means that there are technical problems with the EIN Online Application. It doesn't mean that yous tin't become an EIN online though (like other reference numbers).

Solution: Wait 24 hours and then endeavor the Online Application once again. If you all the same go the error message, you should contact the IRS or apply for an EIN using Grade SS-4.

EIN Reference Number 110 (technical):

Reference number 110 ways that there are technical issues with the EIN Online Application. It doesn't mean that you can't become an EIN online though (similar other reference numbers).

Solution: Expect 24 hours and so endeavor the Online Application again. If you still get the error bulletin, yous should contact the IRS or use for an EIN using Form SS-4.

EIN Reference Number 112 (technical):

Reference number 112 means that in that location are technical bug with the EIN Online Application. At that place are a number of reasons this bulletin tin can announced, but a common one is that their systems have a big amount of users and it'south better to endeavour at another time.

Solution: Endeavor the Online Application again or look 24 hours. If yous notwithstanding get the mistake message, you should contact the IRS or apply using Form SS-four.

EIN Reference Number 113 (technical):

Reference number 113 means that in that location are technical bug with the EIN Online Application. There are a number of reasons this message tin appear, but a common 1 is that their systems take a large amount of users and it's better to attempt at another time.

Solution: Endeavour the Online Application again or look 24 hours. If y'all still go the error bulletin, you should contact the IRS or apply using Class SS-iv.

EIN Reference Number 114 (max EINs per day):

Reference number 114 means that the Responsible Party has already been granted an EIN for the 24-hour interval. An IRS Responsible Political party can only exist assigned 1 EIN per solar day.

Solution: Wait 24 hours and so utilize once more online.

EIN Reference Number 115 (Date of Expiry shows for Responsible Party):

Reference number 115 is when the system runs a date of decease inquiry on the Responsible Party and information technology comes back showing that party equally deceased.

Solution: Contact the IRS if the Responsible Party is not deceased. They may require further documentation to prove this, or they may request filing Form SS-iv by mail or fax instead.

Source: https://www.llcuniversity.com/irs/ein-reference-number/

0 Response to "How to Get an Ein Online Again"

Publicar un comentario